Crypto Mining - Questions from someone who is not looking to mine, rather understand the theory

First of all: Not looking to mine, just curious in general.

I am, among other things, invested in crypto. Due to this, I am also interested in learning more about what I am actually invested in. As such, mining is one of the topics I understand is important to know, as mining efficiency and interest can (probably) be an indicator as to how successful/bright the future of certain coins can look like. In general, it seems mining has become more and more unpopular and I have read many times that it is not worth it anymore. This would probably also have an influence on crypto in general as less miners would likely equate to a shortage of processing power to generate more coins, right? Again, I am a beginner in this field.

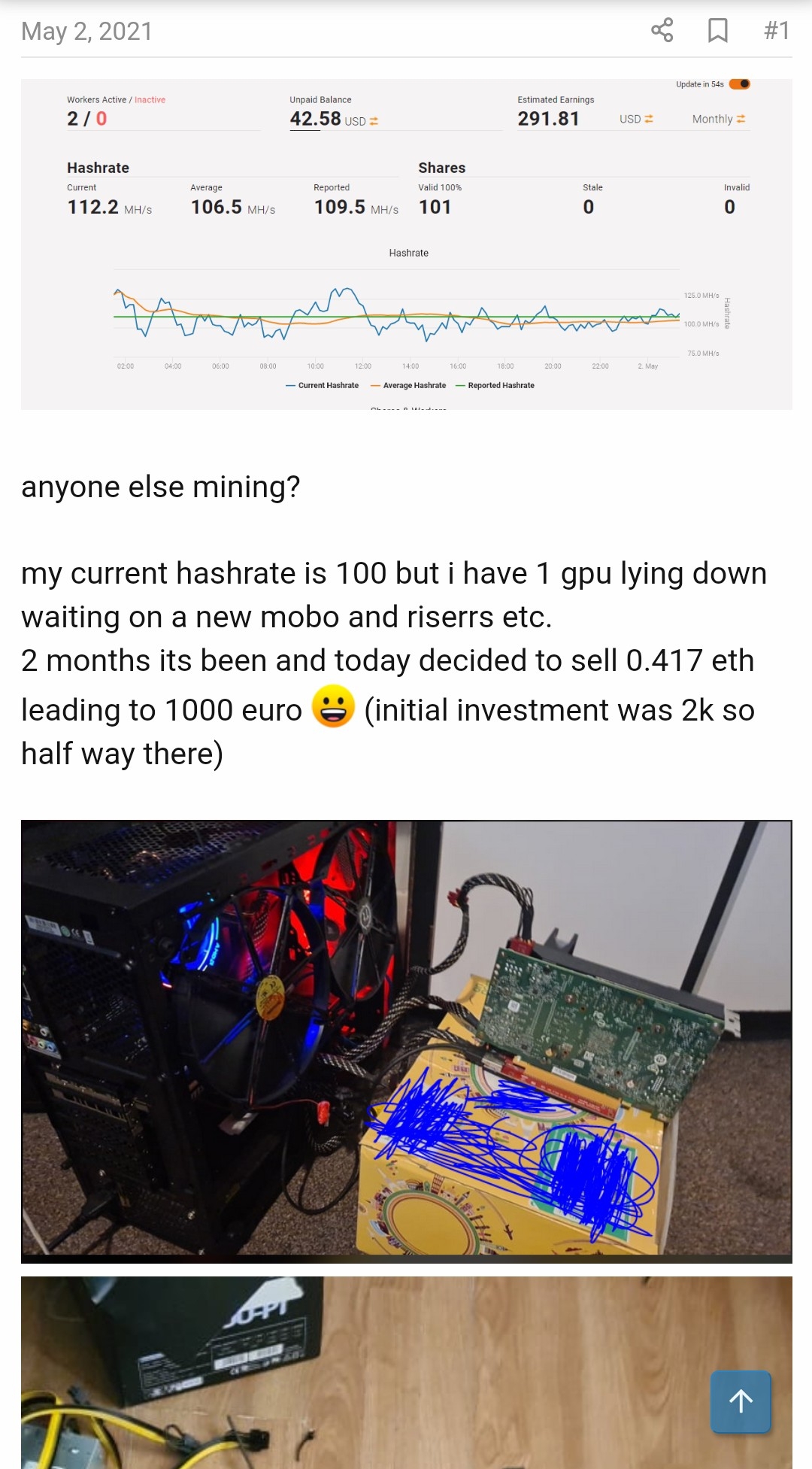

Today, I was suprised to find the post below in a gaming related forum I am in (definitelx not a crypto focused forum) and it seems like even a "small" mining farm can produce profit as well as contribute to the currency in question (in this case ETH). Is the guy mining ETH because his processing power/farm is too small to be efficiently mining BTC? Why is he mining ETH and not SOL/ADA or some shitcoin? What factors motivate a miner to mine a specific currency? All these are questions I am asking myself to try to get a better grasp of how all of this functions. I definitely know providers (such as Hetzner) are not big fans of miners (esp in shared environments). Have you been mining crypto before? What got you started, what made you stop? Have you learned anything during the process? How dependent are small/new coins on an audience that is interested in mining them? Do all coins require mining? Anyway, as you can see there are many questions and I am holding crypto more for the sake of diversifying my portfolio rather than having understood it thoroughly. Any input/explanations or links to useful resources are more than welcome ![]()

When is LESCoin coming to reward contributors and redeem at top providers @mikho @Mason ![]()

Comments

man, you always like to jump head first into pandoras box, aren't you?

not sure what route this topic takes, however, my first suggestion would be to think about at least three important vectors to crypto.

ONE would be the ACTUAL purpose of a coin. why does it exist and what can it be used for. like with BTC you can actually pay for some stuff. most other coins do not even have that (yet). maybe they have a vision or goal, of how they want to change the world be used in the future, however usually are far away from any kind of real world use.

that leads to TWO, pure speculation about how and when to achieve that idea/vision for real. if the creator of the coin can sell a strong goal and reasonable way to get there, people would want a piece of it early and try to buy in or start mining themselves.

THREE then would be the real mining, because that is required to allow the purpose of the coin to be carried out (aka proving the transactions etc.) and this work obviously needs to be rewarded. the harder this work gets (depending on the algorythm/proof of xyz) the higher the reward people expect or they might stop mining or look for a different coin.

there most likely are more angles from which you can look at it, but I suggest to start thinking about first, where you would place yourself. do you want to USE crypto, do you want to BET on their success or do you want EARN from contributing your power.

of course any combination is possible, but still...

I obviously forgot to mention FOUR, the clueless people who simply buy coins, because of fancy charts and again the BET regardless of the functionality or reason behind any coin ;-) ;-)

Haha, just always looking to learn more :P Thanks for replying, mate!

1) This was probably the most important point to me when I bought into crypto. For one, I was looking to diversify my portfolio; additionally, I was looking to pick coins that are well established and (currently) have a use case. I am holding BTC and ETH for these reasons. For example, when I was in Spain, I saw just about 4-5 Bitcoin ATMs in València, which is one way of bringing crypto into "real life" and attaching value to it. Whats more, there is Bitpay which allows you to pay your credit card transactions with Bitcoin adding even more use cases. Then, ofc, there is also TESLA and other companies accepting Bitcoin outright and/or even more coins through several payment gateways. The Deutsche Bank, which recently called Bitcoin and Ethereum the new Gold and Silver, but also other institutions, speak of a bright future for crypto. Speaking of future potential ETHs smart contracts just seemed to be quite the awesome features and I assume many companies (and criminal organisation) will want to make use of a way of doing business without a (biased) middle-man. I realize that with the limited knowledge I have, I am in no position to compete with professional traders and people that are deep into crypto, however, at the same time I'd reckon I can't go wrong with BTC/ETH at this point in time. Especially when "betting" with money that I don't depend upon. Of course, new coins and trends are always gonna come up, and I might not catch the next hype coin in time. But that's fine. It is what is. For the record, I am also "boring" enough to pay higher fees than e.g. at Binance by having signed up with Börse Stuttgarts' "BSDEX" ( https://www.bsdex.de/en/ ). As boring and regulated as it gets. Made in Germany, EUR balance held at german Solaris Bank and crypto hold at german blocknox Gmbh (also belongs Börse Stuttgart) until sent to my wallet.

2) I follow some articles and posts about Buterin and it's always quite the interesting read. Granted, I didn't read that much into Bitcoin's vision, but it seems like it is already established enough at this point in time. ETH, on the other hand, is quite interesting in that regard, and I am following several news sources such as "Krypto Kompass" to learn more about how this turns out.

3) Yeah, that certainly makes sense. It's also just about what I mapped mining out to be like. Proof of Work and Proof of Stake are also some of the concepts that seem to be influential here.

As for my goal with crypto, I don't plan on using it for payments, nor mining. That leaves the last and your initial option: Betting on its success. I'd love to say investing, but it seems too much a gamble to call it that, yet. Then again, quite some german insurances also seem to be a gamble whether you'll see your money back, or whether, once you request them to take action on your behalf, they will just decline your cause and you have paid years for nothing. Many people also trust financial advisors to invest on their behalf (Sparkassen, VR-Banken etc) and, at the end of the day, they often have paid year after year for basically nothing.

4) Shhhhh, we don't do that here..

Ympker's VPN LTD Comparison, Uptime.is, Ympker's GitHub.

Mining's never been where the profits are made. When you calculate the costs in time, equipment, electricity and the potential profit gains by investing that elsewhere.

Buying (at a price that you are convinced with enough probability that will be "low" when you sell), then selling is where the profits are made.

Even Bitcoin - it was relatively easy to mine, but its price was also relatively low. Took some years for it to really rise. Instead of mining, anyone could have just bought some (1000 euro worth or so), then just waited. Without having any extra equipment or electricity costs. All the miners I know sold their BTC too early.

This all leads us to the other problem:

(un)predictability.

If you're knowledgeable about an area, say hosting. Right after what cPanel did the jump in 2019, you could invest in DirectAdmin shares (if they were on the market).

Likewise, as soon as the news from China came at the end of 2019, shorting air-company shares, or large travel agency shares was probably a no-brainer.

With crypto-currencies, the problem is they can be shut-down overnight (governments deciding to ban them), and fluctuations are high. Every price depends on the "mentality" and expectations, but it's difficult to predict those when it comes to crypto - at least IMO.

Either way, for buying and selling, you need huge money to make money that way.

Mining - every kid is trying to get rich overnight. Competition is high, so profit margins... I'd be surprised if that were a wise place to invest time and money. Coud be wrong.

🔧 BikeGremlin guides & resources

Interesting read! Sticking to buy & hold right now. At least in Germany, crypto profits are tax-free after 1 year of holding (until now). The new government might change that, but probably not retrospectively. It's quite the gamble, but then again, more and more people seem to be adding at least a small percentage of 2-7% crypto to their asset allocation. For me it is probably also around 5%. I don't depend on it and if it was gonna be a loss I could live with it quite easily. If it turns out to make a profit and is tax-free, I'll happily take that

Ympker's VPN LTD Comparison, Uptime.is, Ympker's GitHub.

In the last 3 and a bit months, my Crypto returns were shy of $8,500. I would never mine though. I prefer to watch, buy and sell depending on factors that cause such an unregulated market to fluctuate so much. Rarely do I hold Crypto for long.

Watching for a stupid tweet from someone like Elon Musk about a particular coin, buying as soon after that and selling not long after the price inflates (within days, sometimes hours). It's all a bit of good fun if you are up for the risk.

I never do crypto mining, just sharing my experience

My first week with crypto, I got 200% and 400% from two coins, but I was too greedy to sell it. Then BTC falls (mid May) and my fund goes -50%. Since then I never hold any coins and convincing myself that crypto is not good for long term investment, at least for me, who don't have much free money to put on.

Now, I stop reading the crypto news, /r/cryptocurrency, Twitter etc. I feel more sane because I stop checking the phone once in every minute. I just use bot to take very small profit. Less headache and save time.

In your country, are crypto profits tax-free, in general? Or you do (day) trading even if you have to pay taxes? Here in Germany it's one year holding to be tax-free. Trading day-to-day all profits will be taxed with Einkommenssteuersatz which is usually some 35%+ depending on the individual. As a person you can earn about 9000€ tax-free per year, though. Not limited to crypto, but also working jobs etc.

Ympker's VPN LTD Comparison, Uptime.is, Ympker's GitHub.

It was originally seen as Gambling in the UK so no tax, but it is now very much a capital gain therefore taxable. But creatively you can offset to reduce. Not clear cut.

Ah, fair enough. I hear in Portugal it's not taxable at all. Granted, some german financial courts (e.g. one close to where I live) have stated that crypto gainings are not to be of any concern to the tax offices at all, making them tax free as it would be considered like collecting Monopoly Money or letter stamps. If that comes through, perhaps cryptos won't be taxed one day. Then again, I live in Germany, sooo....

Ympker's VPN LTD Comparison, Uptime.is, Ympker's GitHub.

It comes down to electricity cost and whether you have the equipment ultimately. In countries with high elec cost it's a very borderline proposition.

I use my gaming PC for mining since it also provides heat which is useful in itself

Not quite. Mining profits are not cap gain in the UK. Basically it's vanilla income once produced (i.e. at coin value at time of mining) and subsequent gains are cap gain (with value at time of mining being base cost). HMRC has a detailed write-up on crypto. There is also a 1k allowance in uk for sundry income...which might be usable to offset the mining part...but haven't seen any official comment on that

From a perspective coins are volatile. Better open GMBH with some family or friends and just share the capital . It would requiere more work than buying and selling coins but at least you have a ¨gravity¨. Sure you would not earn money in 2 days because some coin skyrockets but the probability of huge loss is neither there so it is OK . In fact i am diversifying 2 companies owned and 2 companies(not dental related) in that way with 7 more dentists so 12.5% share . Less money but for avoiding the inflation for the moment works. I know that you are not getting to put a crazy risk money in coins but ....... we have started with 7k per person the company . So it is better in my personal opinion to diversify . Obviously, it highly depends. There is not risk 0 but well . Just my 2cents .

I believe in good luck. Harder that I work ,luckier i get.

Yeah, depends on many factors, wider wealth and so on. Nothing that I am getting into here.

Crypto is fun, at least from mining (techincal) and trading (financial).

Been in this industry for few years and still stacking my portfolio.

For who is new and would like to invest little money, it is good to start with Dollar Cost Averaging (DCA) on Bitcoin.

Don't mine. Rather run an exchange program. That's where real dough is.

♻ Amitz day is October 21.

♻ Join Nigh sect by adopting my avatar. Let us spread the joys of the end.

and then suddenly one day say that "OOO SOMEONE H4XXED UZ... UR SHITCOINS GONE!!! SO SORReEYYY!!"

Easy money

ExoticVM.com - Find VPS in exotic locations! | PureKVM.com - domain for sale! make offer!

Well, it's an anonymous and unregulated currency. Who cares. I am willing to scam in such a market where there is no law and regulations.

♻ Amitz day is October 21.

♻ Join Nigh sect by adopting my avatar. Let us spread the joys of the end.

I did mine years ago and lost many wallets with a few satoshis on them. Haven’t done it for a few years. I have a friend who runs a program on his PC and uses his GeForce 1070 or something like that (one of the $1000~ GPUs). Allegedly it’s profitable after electricity costs but really depends how long the hardware will last, and it’s their main PC so it’s not 24/7.

I’ve never had the best hardware so never thought about mining again, and I’m not in charge of the electricity costs so I’d rather not interfere. Plus the noise and heat etc etc…

I am buying and holding. I have sold a large % a few times this year, definitely a regret but you always have to make sure to spread your eggs.

Plus with all this de-fi and interest accounts you can theoretically earn as much as you would mining just for holding, at least compared to a home PC set up, I’d rather get to that point than earn the same amount mining with all the negative impacts.

Michael from DragonWebHost & OnePoundEmail

@Ympker you have a lot of questions -- PM me and we can chat via email or call, would be happy to. Can provide some insights, at Dash Cloud we maybe have a dozen (or few) GPUs mining right now. Can share experiences with my first ASIC miner purchased more than 2 years ago with you too

Not everything is very black and white. Electric costs may be high, hardware may be old, but mining may still be profitable. It depends. I view mining as a means to an end for cryptos, eventually mining should cease to exist and all move to PoS. But for now, as long as Eth hasn't implemented PoS, mining will continue to exist. People won't mine shitcoins unless those make more money. And because Ethereum is larger, a lot of people can mine that. But it depends.

Nope. Doesn't fall under the usual is it income or CG criteria stuff that applies to most aspects of crypto

Mining income is explicitly designated as income by HMRC

https://www.gov.uk/hmrc-internal-manuals/cryptoassets-manual/crypto21150

Which is a gigantic mess cause that means you need to track a different price for each bit of crypto generated not just in the year mined but also going forward due to the base cost.

HMRC? Gigantic mess? Noooooo…..

Michael from DragonWebHost & OnePoundEmail

Thanks for the offer, mate Just to clarify, as I am not sure everyone understood it: Not looking to start mining, just looking to understand more about it. That being said, I'd love to shoot you a few questions and/or hear some insight

Just to clarify, as I am not sure everyone understood it: Not looking to start mining, just looking to understand more about it. That being said, I'd love to shoot you a few questions and/or hear some insight  Especially, given that you seem to have quite tue experience to share. I'll pm you later today. That story about your ASIC miner sounds interesting, too!

Especially, given that you seem to have quite tue experience to share. I'll pm you later today. That story about your ASIC miner sounds interesting, too!

Ympker's VPN LTD Comparison, Uptime.is, Ympker's GitHub.

Yep, of course .

.

I joke with my partner (now the CEO of Dash Cloud) that any machine mining is a failure because mining is a terrible business to be in.

Sent you a pm

Ympker's VPN LTD Comparison, Uptime.is, Ympker's GitHub.